On Dec. 1, the US-China trade war came to a temporary halt after a 90 day ‘truce’ was agreed to, preventing further tariffs being implemented. Whether this truce becomes permanent, only time will tell. With the trade war being all but over, a significant question remains: Who is doing better?

A US-China trade war has been looming for several years, Barack Obama’s US and China butted heads many times during his presidency. However, the threat of a trade war escalated with Donald Trump’s rise to power. During his presidential campaign, Donald Trump was highly critical of current U.S trade deals and accused China of being a currency manipulator, making their exports more competitive in the global market. Fast forward 2 years and Trump had reignited his issues with the US’ trade deal with China. On April. 9 2018, he tweeted his displeasure about the differing car tariffs between the countries. 2 months later and Trump’s tweets turned to action as on June 15, 2018, the U.S announced tariffs on $50bn of Chinese imports followed by a second wave of $200bn worth of tariffs in September 2018.

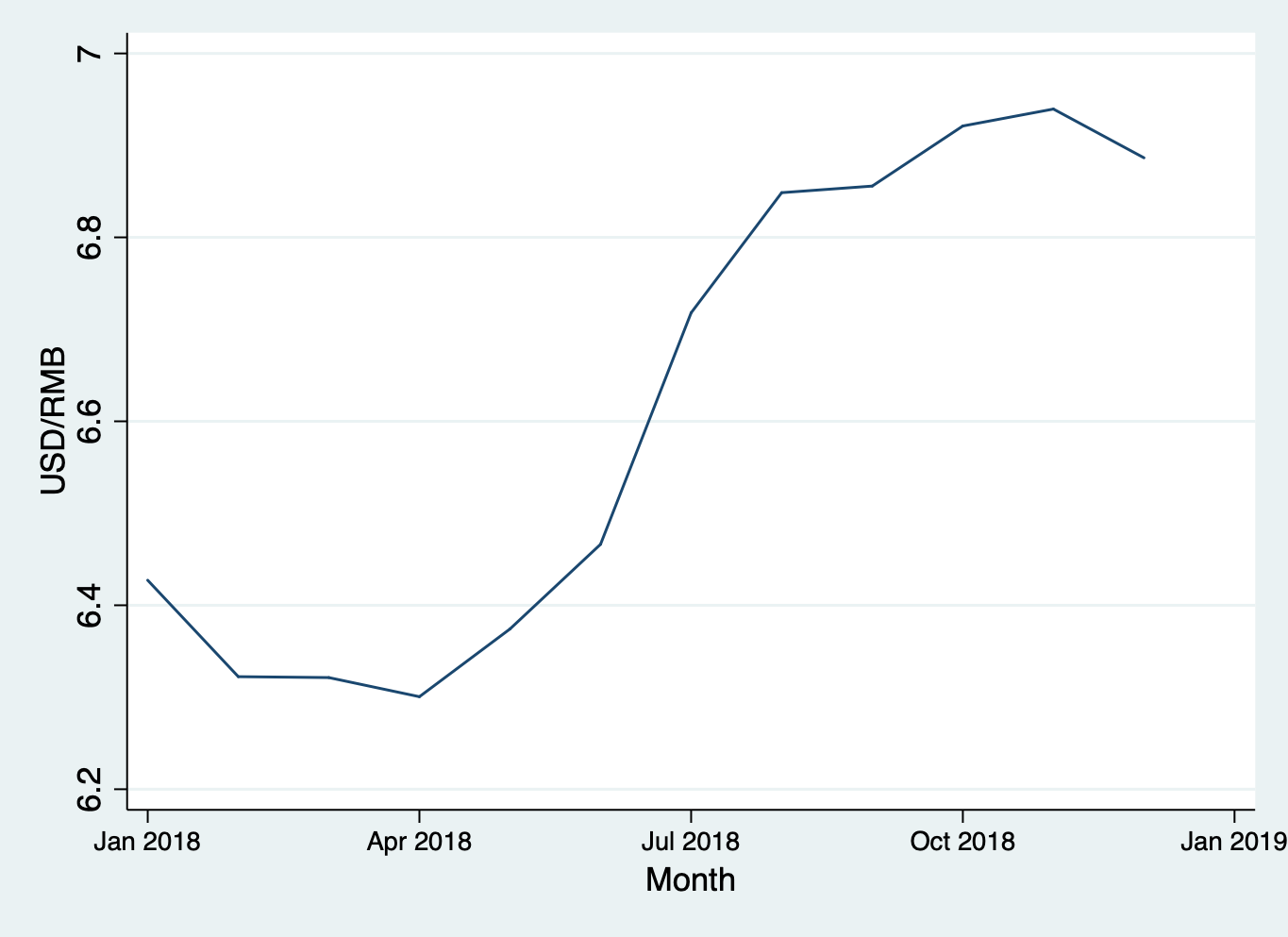

In retaliation to the tariffs, China hit back by reducing the reference rate beyond 6.7Rmb per dollar in July. As shown in table 1, China’s willingness to alter the reference rate has had major implications for the USD/RMB exchange rate as the dollar has appreciated over 10% against the yuan between April to November 2018.

Table 1: USD/RMB Exchange rate

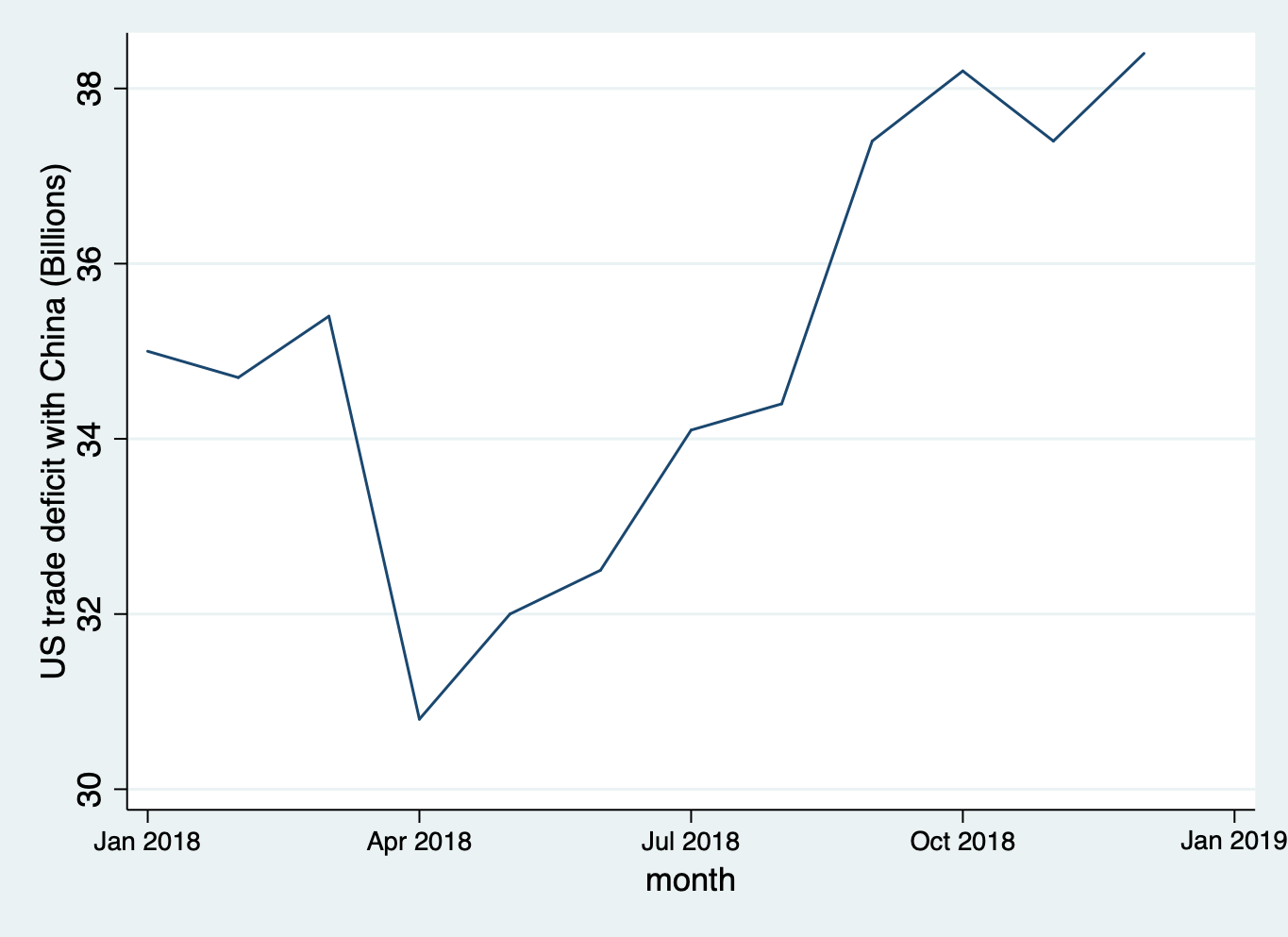

Therefore, given the US tariffs increasing the cost of Chinese imports and China’s tactical exchange rate controls making Chinese exports cheaper, how the trade war has impacted trade between US and China is not clear cut. Fortunately, data published by the Bureau of Economic Analysis (BEA) shows how the US’ trade deficit with China has developed over the course of 2018, this information can be seen below in table 2.

Table 2: US trade deficit with China during 2018

As shown in table 1, between February to April, there is a sharp decline in the US’ trade deficit with China. However, that trend soon changes as since April, 2018, the trade deficit with China has risen steeply to over $38bn, indicating that Trump’s tariffs have been thwarted by China’s depreciating yuan, but why is that?

Firstly, when looking at how changes in the price of imports/exports affect trade, price elasticity of demand (PED) plays a pivotal role. A study by Kumar (2009) found the price elasticity of demand for Chinese exports to be around -1.5 meaning demand for Chinese exports are responsive to changes in the price. Therefore, given that Trump’s tariffs only apply to a fraction (roughly 50%), it is possible that the price reduction of Chinese imports which resulted from the devaluation of the yuan against the dollar, outweighs the price increase associated with the tariffs. Thus, resulting in a net increase in the value which the US imports from China.

Furthermore, China has an unusually fast and large exchange rate pass through (ERPT). ERPT measures how responsive international prices are to changes in the exchange rate. Research carried out by Bouvet et al (2017) found evidence of an almost complete ERPT for exports in China (meaning if the exchange rate decreased 1%, price of exports decrease 1%). Moreover, Shu et al (2008) noted that ERPT occurred almost immediately within China. With a high and quick ERPT, conjunction with price elastic exports, China’s strategy of devaluation is highly effective in the short run and has proven so over the past several months.

However, China may be prevailing in the trade war currently but they play a risky game. Currently, China have done a good job of offsetting the effects of the tariffs. However, with Trump recently indicating that the tariffs may be around for a “substantial period”, companies may take their business elsewhere in the long-run so they can export to the US without the added cost of tariffs. Given that the US is China’s largest trading partner and China’s economy is far more dependent on exports (exports account for 21% of China’s GDP), a prolonged trade war is likely to make China more vulnerable in the future.

Overall, when it comes to dealing with a trade war, it is important to note that it is a marathon and not a sprint. Although China’s current success of combating tariffs have been successful so far but it is difficult to sustain such a trade war and be successful in the long against arguably the most developed economy in the world. However, one thing is clear, in the case of trade wars, with the US deficit with China worsening and China becoming more vulnerable in the long run there are no winners, just a battle to see who will come out the least scathed.